The beef sector is set to close out 2021 on stronger footing than when the year began. Demand for beef, both domestically and internationally, remained robust throughout the year. Beef slaughter also ran strong throughout the year, and the consumer’s willingness to pay for beef products improved alongside higher retail prices. Prices for feeder calves and fed cattle also improved relative to 2020. Looking ahead to 2022, ongoing drought and higher feed costs may create a significant headwind for beef producers.

Beef Demand and Supply

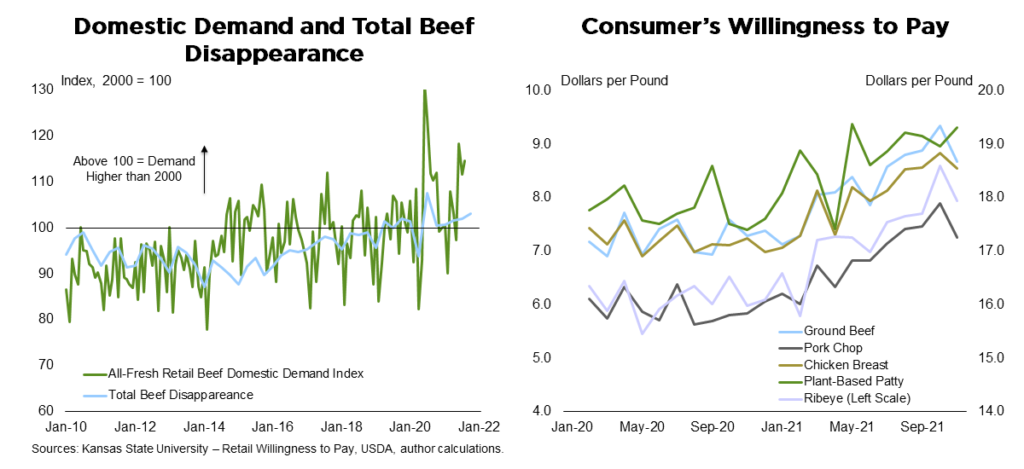

Demand for beef has been robust in 2021. In December, the USDA estimated that total U.S. beef consumption will increase about 1.2 percent compared to 2020. This estimate would be the highest consumption level since 2007, and the highest per-capita consumption level since 2010.

Improved demand has been driven by both domestic consumption and exports. Domestically, consumer demand for beef has remained strong throughout 2021 as evidenced by the domestic demand index readings from Kansas State University. Additionally, the consumer’s willingness to pay for ribeye and ground beef, at the retail level, increased 12 and 19 percent from a year ago in November. Strong demand, coupled with a strong willingness to pay, has helped drive domestic beef consumption.

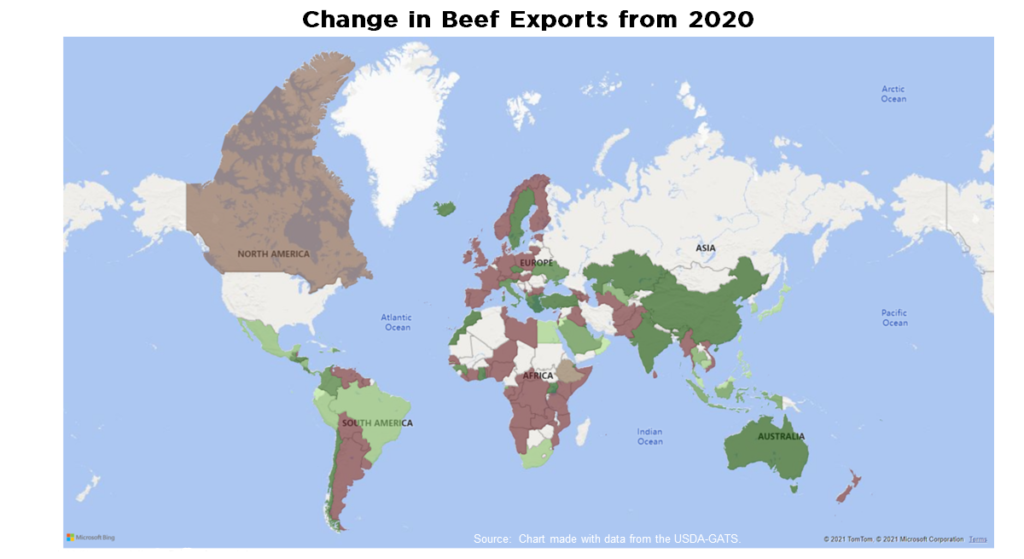

As noted above, export demand also accelerated to record levels in 2021. According to the U.S. Meat Export Federation (USMEF), China, Japan, South Korea, Mexico, and countries in the ASEAN region account for most of the nation’s export volume and increased shipments by 131, 5, 12, 17 and 30 percent, respectively. Beef exports to certain African and South American countries have also improved. Population growth, increased spending power, and a general lift in per capita consumption are likely causes of improved exports and projected growth in export volume. Additionally, herd contractions in Australia and New Zealand provided additional market access in 2021.

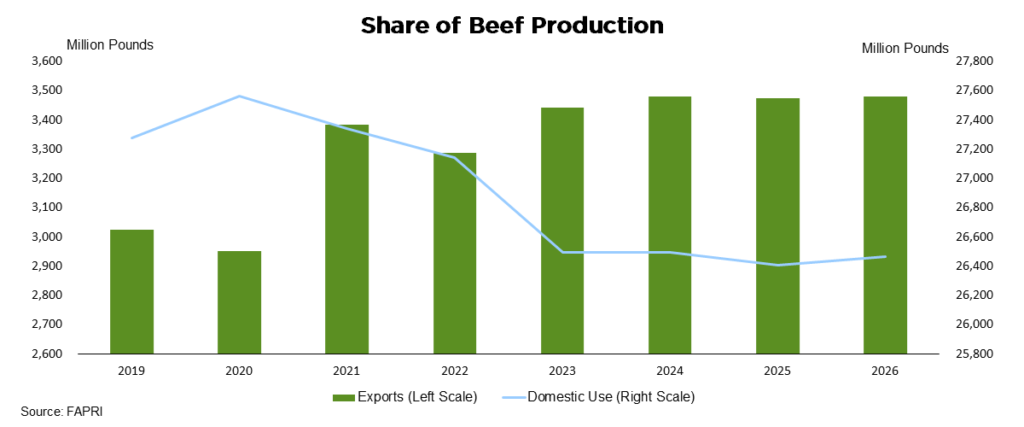

Looking forward, supply chain issues may have an impact on short-term exports, but export growth is expected to continue in the future. For example, the University of Missouri’s Food and Ag Research Policy Institute (FAPRI) forecasts a slight decline in beef exports in 2022 followed by strong growth through 2026. Domestic consumption is expected to slightly decline mostly due to a lower total supply of beef and higher exports in the coming years.

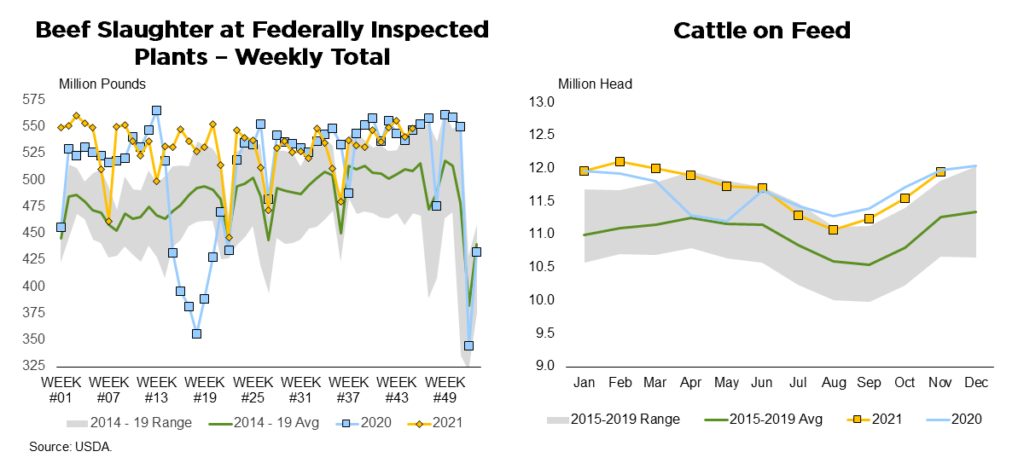

In 2021, beef production has been very strong. The USDA estimates that total U.S. beef production in 2021 will increase 3 percent from 2020 and set a new historical high. Slaughter rates have also run at a historically high pace in 2021.

Through the first 45 weeks of 2021, the total pounds of beef slaughtered is up 3 percent from 2019 levels and up 4 percent from 2020. The strong pace of slaughter is likely to continue as the total number of cattle on feed has trended near historical highs. As noted above, beef production in the coming years is widely suspected to decline as the size the US beef herd shrank over the past several years.

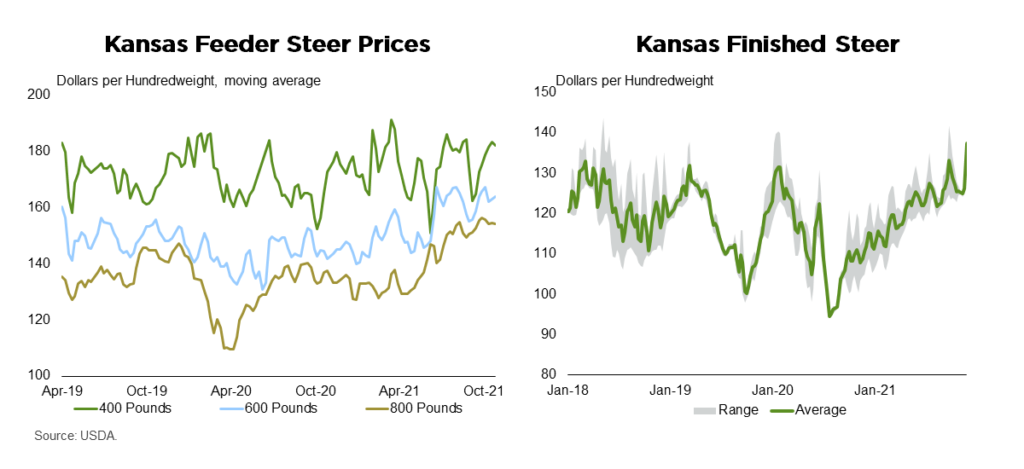

Beef Cattle Prices

Cattle prices have generally improved as strong supply has been met with equally strong to slightly stronger demand. In November, the price of 400 and 800 weight steers in Kansas ran about 6 and 12 percent above year ago averages, respectively. Likewise, fed steer prices in Kansas have steadily improved from the lows observed during initial months of the Covid pandemic. Cattle prices in most of American AgCredit’s territory have followed a similar path. However, in areas of prolonged and intense drought, cattle prices have been somewhat weaker.

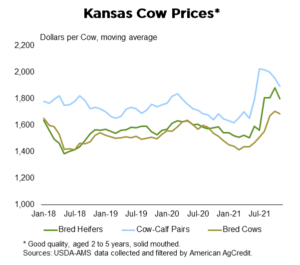

Cow prices have also improved in the second half of 2021. In fact, strong demand in the last several months has pushed prices for good quality replacement cows above recent averages. Some of the recent buying strength may in part be due in part to higher quality cows bringing a premium from ranchers that reduced their herd during the drought and are looking to restock.

Cow prices have also improved in the second half of 2021. In fact, strong demand in the last several months has pushed prices for good quality replacement cows above recent averages. Some of the recent buying strength may in part be due in part to higher quality cows bringing a premium from ranchers that reduced their herd during the drought and are looking to restock.

Cattle Input Prices

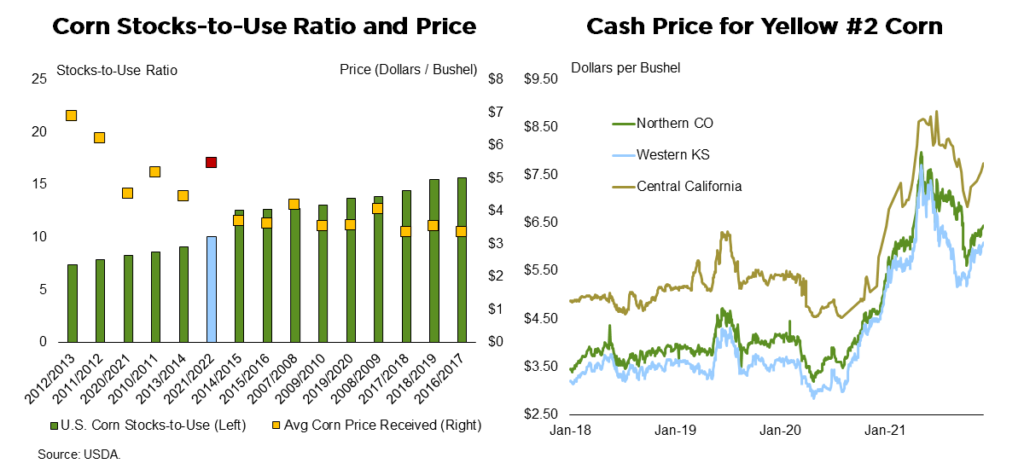

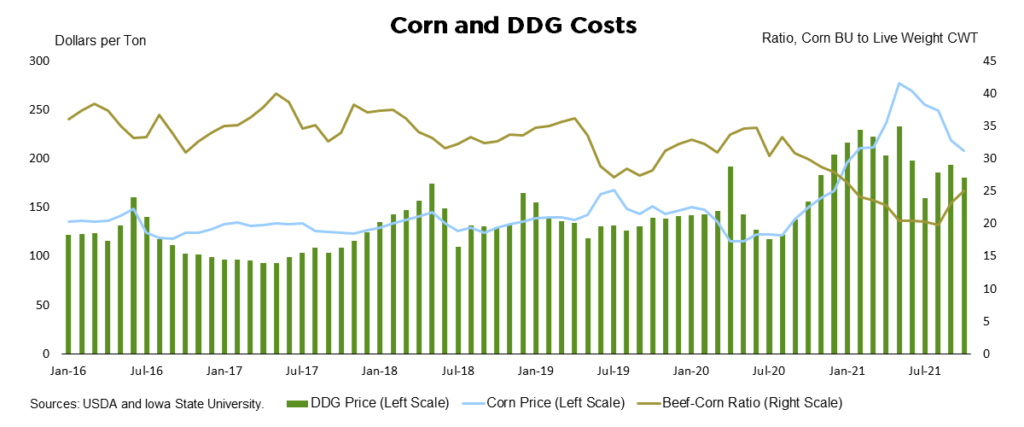

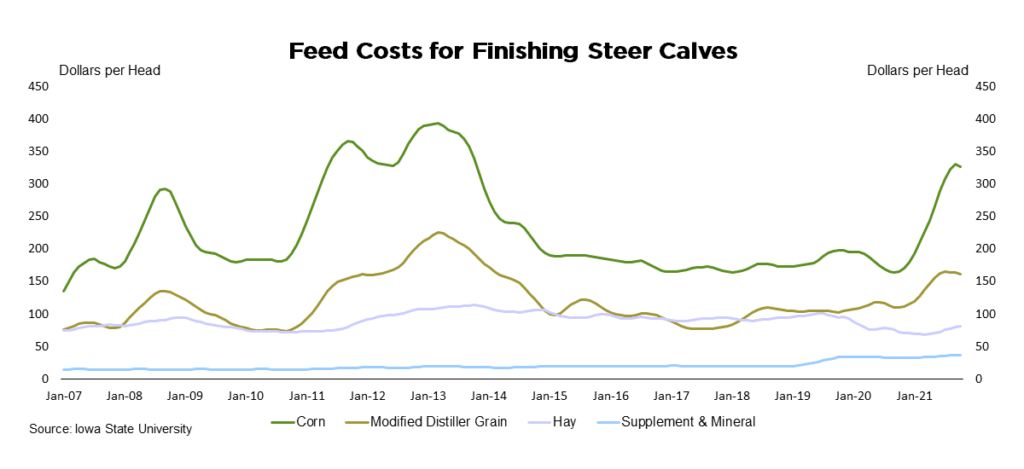

Cattle ranchers and beef operators have felt the pinch recently as input costs have appreciated significantly through most of 2021. Feed costs had been relatively stable from 2015 to 2019, but in 2021 corn prices significantly increased due to tighter than expected supplies.

Compared to a year ago, most corn prices have doubled and the estimated corn cost per finished steer is above $300 for the first time since 2013. According to the most recent USDA World Ag Supply and Demand Estimate (WASDE), the current corn stocks-to-use ratio is about 10 percent, which should continue to support prices through the remainder of 2021 and into 2022.

The increase in corn costs also bled into higher cost for dried distillers’ grains (DDGs). In October, the estimated cost per head of dried distiller grain was around $160, 46 percent higher than one year ago.

In addition to rising corn cost, the demand for ethanol has significantly increased as the economy begins to reopen. According to the Renewal Fuels Association, domestic demand for ethanol in the first nine months of 2021 is about 9.6 percent above year ago levels. Year-to-date production increased at a slightly slower pace of 7.3 percent compared to last year.

As a result of demand increasing at a quicker pace than supply, the days of available stocks in reserve declined to 20.7 in September, well below the five-year average of 22.8 days. Lower ethanol stocks and increased demand for ethanol had the combined impact of pushing both corn prices and dried distillers grain prices higher for cattle producers. It is likely that tight ethanol and corn supplies will support distillers grain prices into 2022.

In addition to grain prices, hay prices have increased substantially in drought-stricken regions. For example, according to the USDA, the average hay price in California is about 12.5 percent above 2020 prices in October. Supplement and mineral prices have also followed the upward inflation trend.

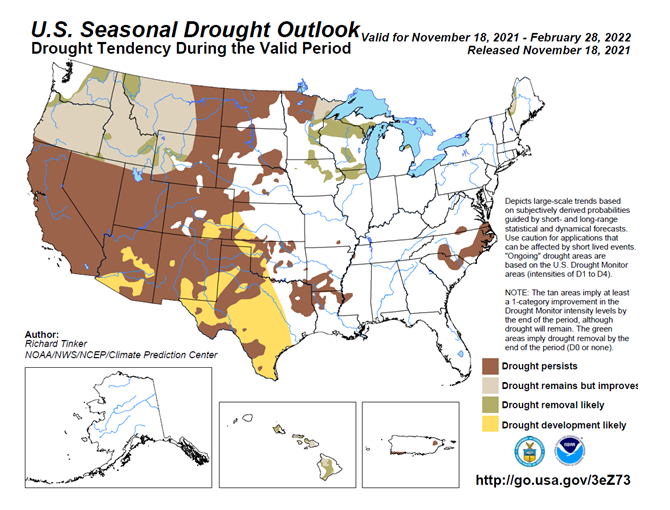

Looking forward, drought is likely to impact feed prices in the coming months. As La Nina may unveil its weather pattern, NOAA predicts drier conditions this winter for much of western, southwestern and southern plains regions of the U.S. The northern regions of the U.S. may experience some relief with normal levels of precipitation. Prices for hay, grains and other winter forages are likely to appreciate in these regions alongside the drought.

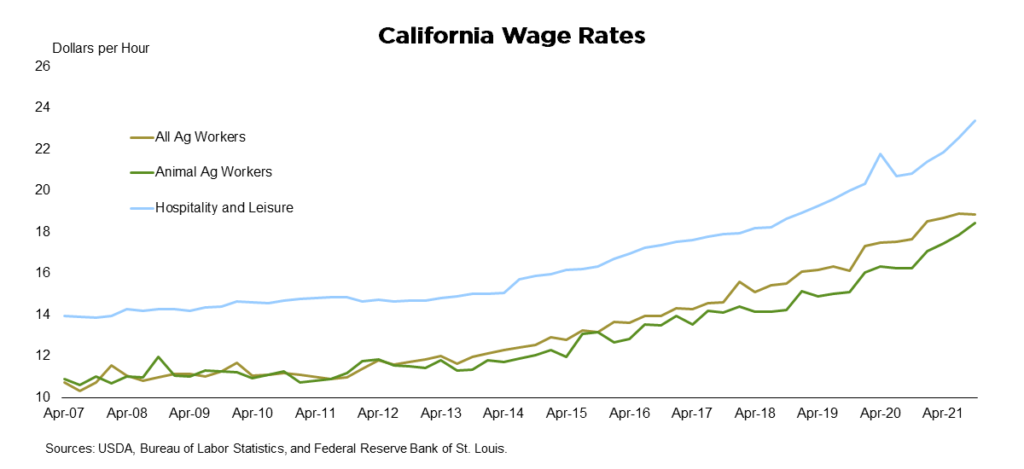

In addition to feed costs, labor costs have also increased. For example, the USDA reports that in California the wage for all agricultural workers increased 7 percent and wages for animal agricultural workers increased 14 percent from a year ago in the third quarter. This upward movement is also consistent with general wage inflation in other sectors such as construction and hospitality and leisure.

As a result, the cost and pressure to hire and keep employees has risen for many producers. Given the general level of inflation, it is probable that wages will remain under pressure in 2022.

Putting it together, the sentiment for input prices in the near-term is pessimistic. Demand for corn, ethanol, and other feed grains is likely to remain strong in 2022 and prices are likely to remain elevated. The ongoing drought situation in many western regions is also likely to keep hay prices elevated and challenge pasture conditions.

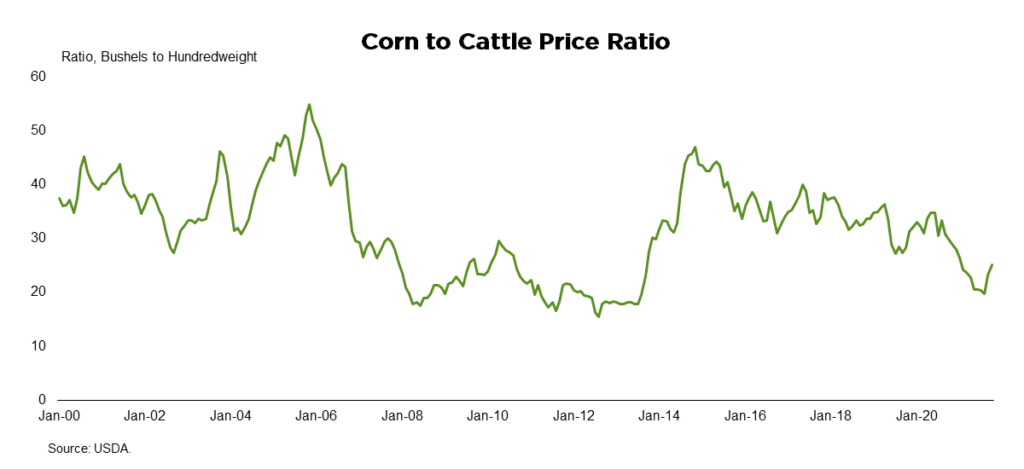

Elevated input prices will weigh on profit margins, but calf and fed cattle prices have been strong, helping to offset some margin compression. In fact, even as corn prices have remained elevated, stronger fed cattle prices have helped to slightly improve the corn-to-cattle price ratio. In 2022, producers will have to tactfully navigate input prices, particularly in the early parts of the year, to maintain strong profit margins.

Concluding Thoughts

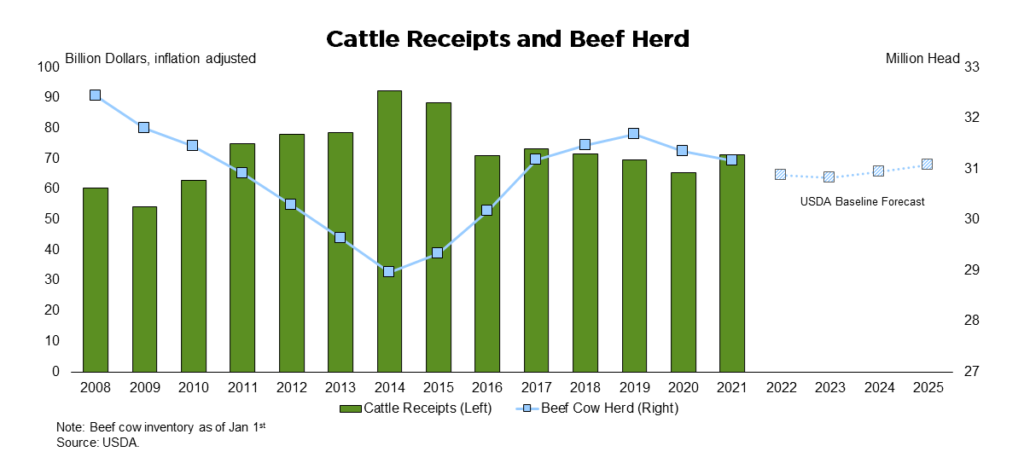

In general, 2021 is set to end on better footing than the year began. The USDA estimates total cattle receipts increased 9 percent from a year ago, the largest year-over-year increase since 2014. Cattle prices largely improved throughout the year, fueled by excellent demand from U.S. consumers and export markets.

Most forecasts expect both domestic and export demand to remain strong in 2022, providing a strong tailwind for the industry. However, drought conditions, feed costs, labor costs, and general input cost inflation provide a very stiff headwind to the industry heading into 2022. The USDA does forecast a slight reduction in the beef cow herd through 2022 and 2023. If demand can continue to grow, the decline in the beef herd may help support higher cattle prices and provide some offset to higher input prices.

LEARN MORE

To learn more about financial services tailored for your cattle operation, visit our contact page or call us today at 800.800.4865.

Disclaimer: This material is for informational purposes only and cannot be relied on to replace your own judgment or that of the professionals you work with in assessing the accuracy or relevance of the information to your own operations. Nothing in this material shall constitute a commitment by American AgCredit to lend money or extend credit. This information is provided independent of any lending, other financing or insurance transaction. This material is a compilation of outside sources and the various authors’ opinions. Assumptions have been made for modeling purposes. American AgCredit does not represent that any such assumptions will reflect future events.