Draft & Mail Fraud

Fraud Facts:

- Drafts/ Checks are the payment methods most vulnerable to fraud.

- Draft /Check fraud has increased nationwide by 385% since the pandemic.

- In 2023 The United States Postal Service issued a bulletin regarding draft/check fraud and mail fraud, urging individuals to stop mailing paper payment instruments due to the explosion of draft/check fraud related to mail theft.

- In 2023 nearly 1/3 of all small businesses were victims of draft/check fraud, and of those over 65% reported losses exceeding $50,000.

- According to the Better Business Bureau the average fake draft/check scam results in a loss of $1,500.00 per item.

What can I do to prevent becoming a victim of draft/check fraud?

- Enroll in online banking and electronic statements to protect your financial information.

- Monitor and reconcile your accounts daily using electronic banking.

- Report any suspicious transactions to your financial institution immediately upon discovery.

- Utilize electronic payment methods such as ACH to send or receive funds and to pay vendors.

- Do not mail payment instruments. If you must mail a draft or check walk the item inside the post office and deposit it in the outgoing mailbox.

- Consider a Post Office Box for business or financial correspondence to prevent sensitive information being exposed during the mailing process.

Equipment Scams

The Secret Service warns about two main types of online sales and auction fraud.

- Non-delivery: A consumer sends a payment to a website or auction site to purchase equipment, but the equipment is never delivered.

- Non-payment: A scammer receives merchandise or a service but does not remit payment to the seller.

With online equipment sales gaining popularity, it is imperative that we educate ourselves on the dangers of online purchases from fake dealers. Learn more about these scams.

What should I do to reduce my risk?

Watch out for fake dealer sites. Research the seller and verify who owns the company website and when it was created. Use an online search engine to look up scams associated with the seller.

Carefully examine the equipment. Request a video call to view the piece of equipment or enlist a trusted third party to inspect it on your behalf if you are unable to travel to the location.

Look for red flags.

- Is the seller pushing you to act quickly? Many times, high pressure tactics are a sign of fraudulent transactions; the fraudster wants you to act now and think later after they have already disappeared with your funds.

- Does the physical address belong to an equipment seller? Verify with a map search online.

- Is the price too good to be true? Or is the seller going to great lengths to justify the low price of the equipment? Research the market value and pricing trends of similar items before bidding.

- Are you unable to reach the seller by phone? Phone numbers that consistently go to voice mail can be a red flag. This allows the scammer time to formulate a response to your inquiries.

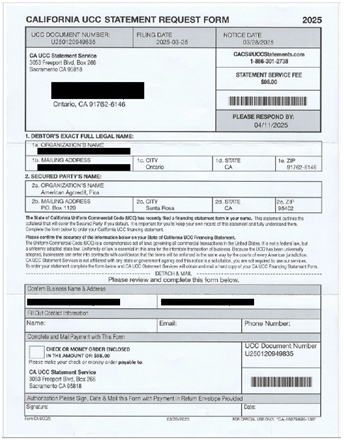

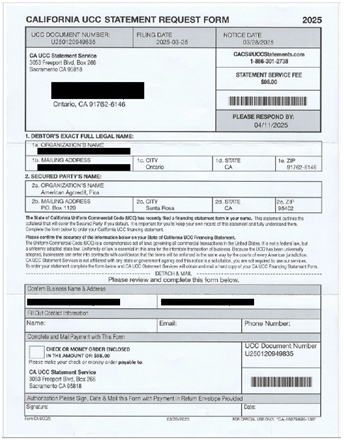

UCC Mailer Scams

- This mailing purports to be from the Secretary of State and is requesting payment for a “statement service fee.”

- These forms are in no way associated with the California Secretary of State and should not be paid.

- Upon closer inspection of the fine print on the mailing, you will see this sentence, “CA UCC Statement Services is not affiliated with any state of government agency, and this notice is a solicitation, you are not required to use our services.”

What should I do?

Verify the source. Legitimate UCC filings and renewals are managed by state government offices. If you receive a letter of solicitation, check to verify it’s from an official government agency. Contact your state’s Secretary of State office or the appropriate agency directly, using contact information from their official website.

Review the details. Official notices will typically include specific details about your filing, such as the filing number, date, and sometimes even your business’s registered name. Scammers might use generic or incorrect details.

Look for red flags. Be cautious of unsolicited letters that:

- Ask for payment via unconventional methods (e.g., personal checks, money orders, or wire transfers).

- Do not provide clear contact information or legitimate business addresses.

- Have urgent or threatening language, pressuring you to act quickly.