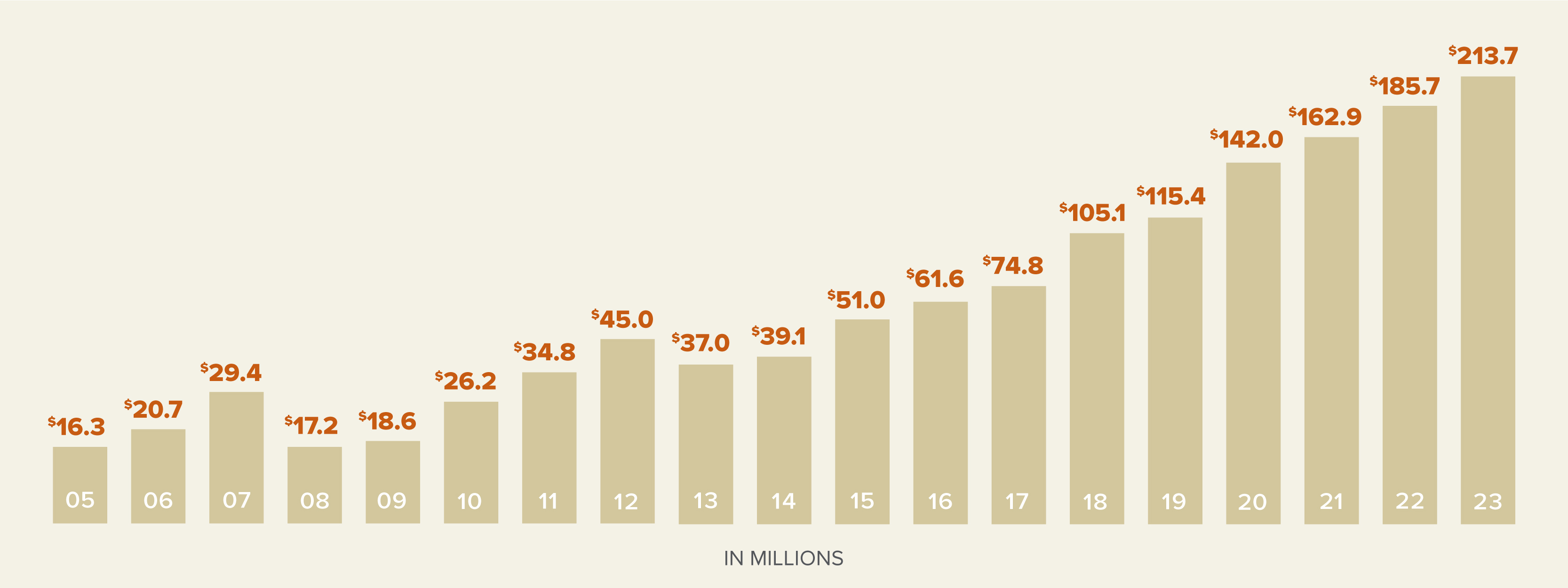

For the sixth year in a row, our Board approved our cash patronage distribution at a full 1%, an estimated $214 million cash back to you, our loyal customers.

For 19 consecutive years, we’ve been able to return a portion of our earnings to our customers, totaling nearly $1.4 billion.