Bifurcation in North Coast Vineyard Values

Report Snapshot

Situation

Higher interest rates, variability in grape production, and longer-term trends in wine consumption have raised some concerns over vineyard valuations in Napa and Sonoma counties.

Outlook

Values for top end vineyards in Napa and Sonoma counties increased in 2022 compared to year ago levels, and values for average vineyards remained stable. Values for top end vineyards are expected to remain strong in 2023, but the high cost of development and water limitations will likely keep downward pressure on developmental acreage in the coming months.

Presented by:

![]()

Bifurcation of Vineyard Values

The market surrounding vineyard values has been somewhat stormy as interest rates have increased significantly, grape production has been hampered by natural disasters and drought, the growth in wine sales has slowed, and coming water legislation remains top of mind. My research finds that average vineyard valuations in Napa and Sonoma counties remain mostly stable, and the value of top end, high-quality vineyards increased modestly in 2022 from year-ago levels.

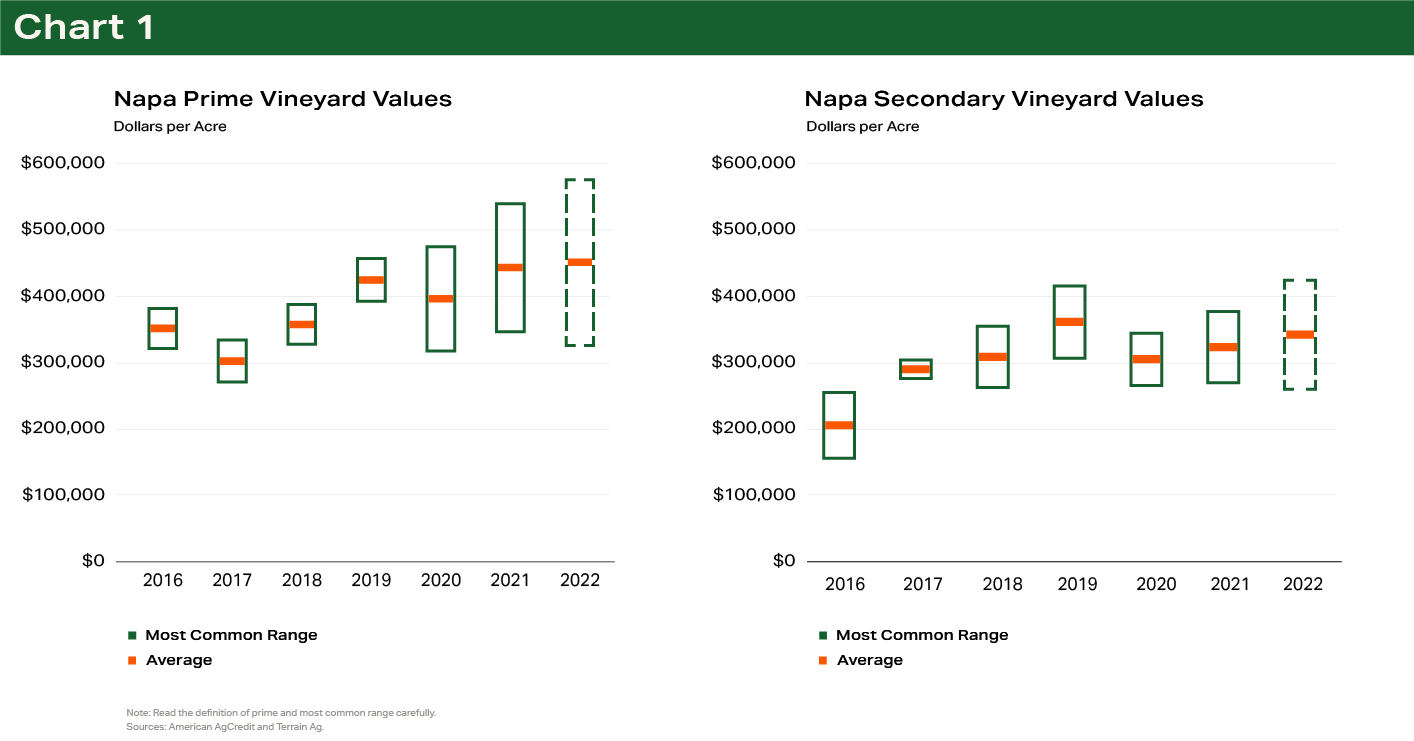

To quantify the changes in vineyard values, vineyard sales data was broken into prime and secondary locations. Prime locations include vineyards that are young-to-mid aged, conducive to high value grape varieties, have high existing grape contracts or bottle pricing, and have a strong reputation. The sales data was then broken into quartiles and the highest and lowest sales were sorted out to get a ‘most common’ range of sales using the middle quartiles. The mid-quartile method helps establish the broader trend of a host of sales over the course of the year, though, it should be noted that some sales in 2022 were well above the most common range.

Looking at the prime market in Napa County, the average value increased very slightly from the previous year, the third consecutive increase. The top end of the mid-quartile range increased about 7 percent from a year ago, the fifth consecutive year-over-year increase. However, the bottom end of the mid-quartile range declined from the previous year.

In secondary locations in Napa County, the value of vineyards in the top end of the range increased in value by about 11 percent, and the lower end of the range declined in value about 3 percent. The average value remained largely unchanged. The bifurcation between the top end and lower end in both prime and secondary locations gives a nod to choosier investments as the cost of borrowing and farming have increased.

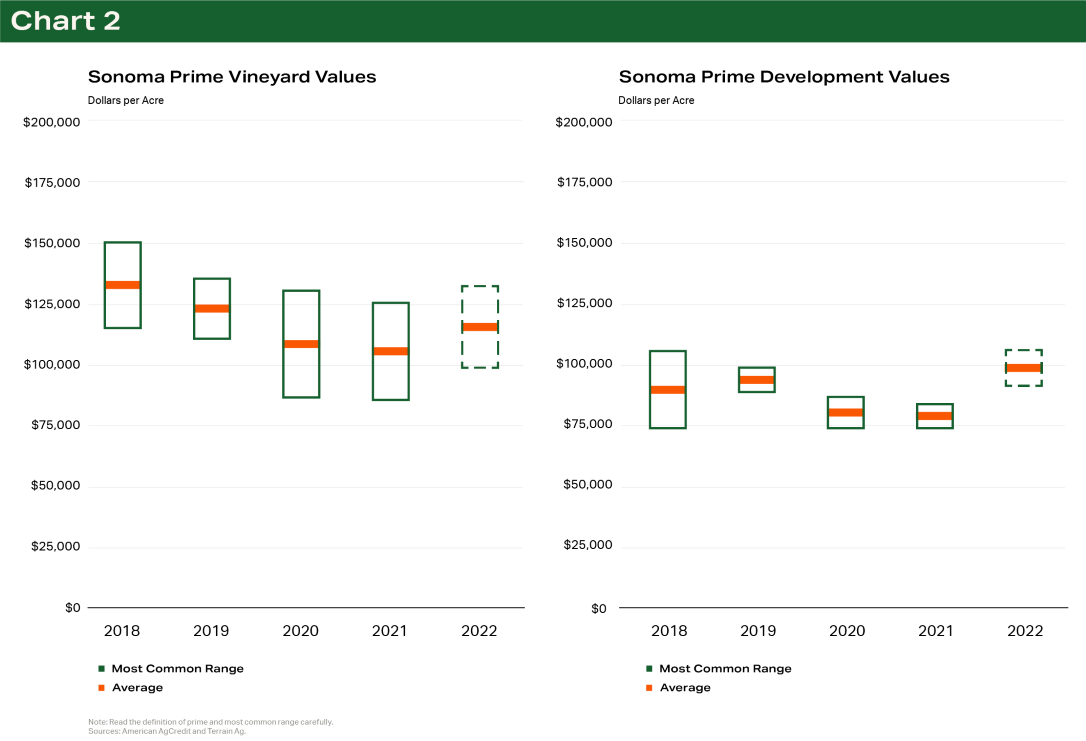

The trend in vineyard values has been similar in Sonoma County. The top end of vineyards in prime locations increased 5 percent from a year ago and the lower end improved slightly after several years of decline. Developmental land in prime locations in Sonoma County also significantly increased after several years of modest decline.

In 2023, I expect several trends in vineyard values to develop. First, I expect a widening of the gap between top end and lower end vineyard values. The financial and opportunity cost of financing and operating vineyards will focus investors more heavily on top end vineyards. Larger vineyards may also be more willing to ‘pay up’ on higher quality vineyards to gain control of high-quality grape production. Moreover, potential water restrictions on new developments may also push additional demand to strong vineyards with a history of strong production and contract prices.

Second, the value of plantable, or developmental, acreage is likely to flatten or moderate very slightly. The cost to develop land has significantly increased alongside inflation in labor, construction materials, equipment, etc. The cost to borrow on developmental acreage has risen with the interest rate market. Additionally, the amount of potential acreage to develop is somewhat limited to more difficult areas with more uncertain returns. The potential for future limitations on new wells may also cause significant hesitation on plantable land purchases.

Read more Wine Industry Insights

Disclaimer: This material is for informational purposes only and cannot be relied on to replace your own judgment or that of the professionals you work with in assessing the accuracy or relevance of the information to your own operations. Nothing in this material shall constitute a commitment by American AgCredit to lend money or extend credit. This information is provided independent of any lending, other financing or insurance transaction. This material is a compilation of outside sources and the various authors’ opinions. Assumptions have been made for modeling purposes. American AgCredit does not represent that any such assumptions will reflect future events.